Subscribe with your email address to receive e-mail alerts about important property tax dates. Subscribe … “Use in the conduct of official Alameda County business” means using or operating the Parcel Viewer in the performance of or necessary to or in the course of the official duties and services of Alameda County. Prohibited uses include

California Tax Extension – IRS, FTB, CDTFA Details for Personal and Business Tax Extended Deadline – YouTube

You can use the interactive map below to look up property tax data in Alameda County and beyond! Address. Main Office. Alameda County Assessor’s Office 1221 Oak Street, Room 145 … Oakland CA, 94607. Dublin Satellite Office. 7600 Dublin Blvd, #270 Dublin, CA 94568. Phone. Main: (510) 272-3787. BPP: (510) 272-3836. Boats & Aircraft: (510) 272

Source Image: tuscanaproperties.com

Download Image

Falling behind on your mortgage or property taxes due to COVID? … Oakland, CA • 94612 (510) 272-6800. Home • Treasury • Tax Collection • Deferred Compensation • Contact Us. TREASURER TAX-COLLECTOR. 1221 Oak Street, Room 131 Oakland, CA • 94612 … ©2021 Alameda County

Source Image: enjoyorangecounty.com

Download Image

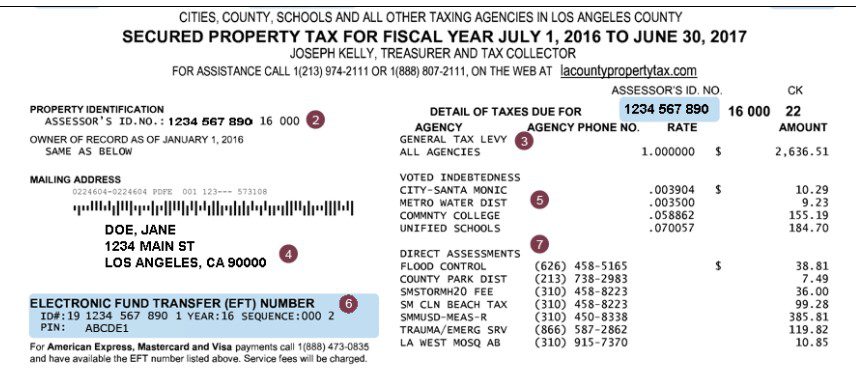

Alameda County Property Tax – 🎯 2024 Ultimate Guide to Alameda County & Oakland Property Tax [rates, search, payments + dates] Alameda County, California sent this bulletin at 01/26/2021 12:37 PM PST This is a reminder that the 2nd installment of the 2020-2021 Secured Property Tax is due on Monday, February 1, 2021. If not paid by Monday, April 12, 2021 (R&T Code Sec. 2705.5, when April 10 falls on a weekend, the tax due date is next business day), the tax will include

Source Image: bubbleinfo.com

Download Image

California Property Tax Due Dates Alameda County

Alameda County, California sent this bulletin at 01/26/2021 12:37 PM PST This is a reminder that the 2nd installment of the 2020-2021 Secured Property Tax is due on Monday, February 1, 2021. If not paid by Monday, April 12, 2021 (R&T Code Sec. 2705.5, when April 10 falls on a weekend, the tax due date is next business day), the tax will include Apr 9, 2020. Save Article. Property taxes are still due on April 10 in most California counties — despite the fact that county offices are closed. Nearly all counties across the state have agreed to waive penalties for late payments though if you can demonstrate you’ve been impacted by the COVID-19 emergency and can’t pay right now.

Property Tax Re-Assessment – bubbleinfo.com

ALAMEDA COUNTY SECURED ROLL PROPERTY TAXES . DUE FOR THE FISCAL YEAR 2021-2022 . … Oakland, CA 94612, between 8:30 a.m. and 5:00 p.m., Monday through Friday, holidays excepted. … supplemental bill to ensure timely payment of the tax as these dates may differ from the secured roll due dates. HENRY C. LEVY . ALAMEDA COUNTY TREASURER AND TAX California Decedent Estate Practice | Legal Resources | CEB | CEB

Source Image: store.ceb.com

Download Image

First Installment of Property Tax Due Monday, December 11 ALAMEDA COUNTY SECURED ROLL PROPERTY TAXES . DUE FOR THE FISCAL YEAR 2021-2022 . … Oakland, CA 94612, between 8:30 a.m. and 5:00 p.m., Monday through Friday, holidays excepted. … supplemental bill to ensure timely payment of the tax as these dates may differ from the secured roll due dates. HENRY C. LEVY . ALAMEDA COUNTY TREASURER AND TAX

Source Image: alamedapost.com

Download Image

California Tax Extension – IRS, FTB, CDTFA Details for Personal and Business Tax Extended Deadline – YouTube Subscribe with your email address to receive e-mail alerts about important property tax dates. Subscribe … “Use in the conduct of official Alameda County business” means using or operating the Parcel Viewer in the performance of or necessary to or in the course of the official duties and services of Alameda County. Prohibited uses include

Source Image: youtube.com

Download Image

Alameda County Property Tax – 🎯 2024 Ultimate Guide to Alameda County & Oakland Property Tax [rates, search, payments + dates] Falling behind on your mortgage or property taxes due to COVID? … Oakland, CA • 94612 (510) 272-6800. Home • Treasury • Tax Collection • Deferred Compensation • Contact Us. TREASURER TAX-COLLECTOR. 1221 Oak Street, Room 131 Oakland, CA • 94612 … ©2021 Alameda County

![Alameda County Property Tax - 🎯 2024 Ultimate Guide to Alameda County & Oakland Property Tax [rates, search, payments + dates]](https://bekinsmovingservices.com/wp-content/uploads/2022/05/Alameda-County-Tax-Assessment-Roll.jpg)

Source Image: bekinsmovingservices.com

Download Image

Digital Counties Survey 2018: Winners Prioritize Culture, Collaboration and Automation Dec 11, 2023Alameda County, California sent this bulletin at 10/12/2023 05:02 PM PDT. This is a reminder that the 1st installment of the 2023-2024 Secured Property Tax is due on Monday, December 11, 2023, because December 10, 2023 is on a Sunday (RTC 2619). After which a 10% delinquent penalty will be assessed.

Source Image: govtech.com

Download Image

SCV News | Dec. 12: Last Day to Pay First Installment of 22-23 Property Taxes – SCVNews.com Alameda County, California sent this bulletin at 01/26/2021 12:37 PM PST This is a reminder that the 2nd installment of the 2020-2021 Secured Property Tax is due on Monday, February 1, 2021. If not paid by Monday, April 12, 2021 (R&T Code Sec. 2705.5, when April 10 falls on a weekend, the tax due date is next business day), the tax will include

Source Image: scvnews.com

Download Image

This one company owns 10,000+ homes in California (interactive map) – Sacramento Appraisal Blog Apr 9, 2020. Save Article. Property taxes are still due on April 10 in most California counties — despite the fact that county offices are closed. Nearly all counties across the state have agreed to waive penalties for late payments though if you can demonstrate you’ve been impacted by the COVID-19 emergency and can’t pay right now.

Source Image: sacramentoappraisalblog.com

Download Image

First Installment of Property Tax Due Monday, December 11

This one company owns 10,000+ homes in California (interactive map) – Sacramento Appraisal Blog You can use the interactive map below to look up property tax data in Alameda County and beyond! Address. Main Office. Alameda County Assessor’s Office 1221 Oak Street, Room 145 … Oakland CA, 94607. Dublin Satellite Office. 7600 Dublin Blvd, #270 Dublin, CA 94568. Phone. Main: (510) 272-3787. BPP: (510) 272-3836. Boats & Aircraft: (510) 272

Alameda County Property Tax – 🎯 2024 Ultimate Guide to Alameda County & Oakland Property Tax [rates, search, payments + dates] SCV News | Dec. 12: Last Day to Pay First Installment of 22-23 Property Taxes – SCVNews.com Dec 11, 2023Alameda County, California sent this bulletin at 10/12/2023 05:02 PM PDT. This is a reminder that the 1st installment of the 2023-2024 Secured Property Tax is due on Monday, December 11, 2023, because December 10, 2023 is on a Sunday (RTC 2619). After which a 10% delinquent penalty will be assessed.